missoula montana sales tax rate

Sentencing is set for Aug. Base state sales tax rate 0.

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax.

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

. Get a quick rate range. Sales Tax and Use Tax Rate 2022 - description are given below. 4 rows The current total local sales tax rate in Missoula MT is 0000.

368 rows Average Sales Tax With Local. Did South Dakota v. There is no local add-on tax.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. For an accurate tax rate for each jurisdiction add other applicable local rates on top of the base rate. Has impacted many state nexus laws and sales tax collection requirements.

Montana Sales Use Tax Information. Sales Tax Rate Lookup. While the base rate applies statewide its only a starting point for calculating sales tax in Montana.

Download all Montana sales tax rates by zip code. - The Median household income of a Missoula resident is 41968 a year. The East Missoula sales tax rate is 0.

Montana state sales tax rate. Also some other Consumption taxes such as Vendor Tax Consumer Tax etc. The Missoula Montana sales tax is NA the same as the Montana state sales tax.

0 State Sales tax is -----NA-----. Wayfair Inc affect Montana. This means that depending on your location within Montana the total tax you pay can be significantly higher than the 0 state sales tax.

Exact tax amount may vary for different items. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----.

There is 0 additional tax districts that applies to some areas geographically within Missoula. It would not exceed 4 similar to the 2019-approved resort tax rates for Montana. The state sales tax rate in Montana is 0000.

Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount -----NA-----. The 2018 United States Supreme Court decision in South Dakota v. - Tax Rates can have a big impact when Comparing Cost of Living.

Montana has no sales tax. The Montana sales tax rate is currently 0. If the local option sales tax were to pass it would be enacted for 10 years unless residents vote to repeal it during that time.

59812 - State Sales And Use Tax Rates -. The Missoula sales tax rate is NA. While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected.

The Montana State Montana sales tax is NA the same as the Montana state sales tax. Smith 37 pleaded guilty to possession with intent to distribute meth and fentanyl and to a drug user possessing a firearm charges. - The Income Tax Rate for Missoula is 69.

Vehicle owners to register their cars in Montana. Montana is one of. 0 State Sales tax is -----NA-----.

The Missoula County sales tax rate is. Tax rates last updated in April 2022. 1 hour agoSavannah S.

Sales Tax and Use Tax Rate of Zip Code 59803 is located in Missoula City Missoula County Montana State. 9 rows Montana has a 0 sales tax and Missoula County collects an additional NA so the minimum. Although Missoula county levies a local option tax the tax only applies to light vehicles so it does not impact the cost of.

SB313 outlines local sales tax proceeds to be split with 50 allocated to infrastructure affordable housing and administration. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to. The 2018 United States Supreme Court decision in South Dakota v.

There are no local taxes beyond the state. Income and Salaries for Missoula - The average income of a Missoula resident is 25275 a year. The US average is 28555 a year.

There are additional taxes. The combined sale tax rate is 0. Sales Tax and Use Tax Rate of Zip Code 59806 is located in Missoula City Missoula County Montana State.

The minimum combined 2022 sales tax rate for Missoula County Montana is. The Montana state sales tax rate is currently. This is the total of state and county sales tax rates.

The Montana MT state sales tax rate is currently 0. Sales tax region name. The US average is 46.

2022 Montana state sales tax. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. Montana has no state sales tax and allows local.

The County sales tax rate is 0. The Montana State Sales Tax is collected by the merchant on all qualifying sales made within Montana State. The December 2020 total.

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Income Tax Mt State Tax Calculator Community Tax

Montana Sales Tax Rates By City County 2022

State And Local Sales Tax Rates 2013 Map Income Tax Property Tax

9425 Woodwind Trl Missoula Mt 59808 Mls 21910322 Zillow Missoula Home Loans Home Inspector

Our Experienced Advisers Can Help With Hongkong Staff Employment Regulations And Contractual Terms To Internal Communications Business Names Human Resources

Montana Retirement Tax Friendliness Smartasset

Cannabis Tax Montana Department Of Revenue

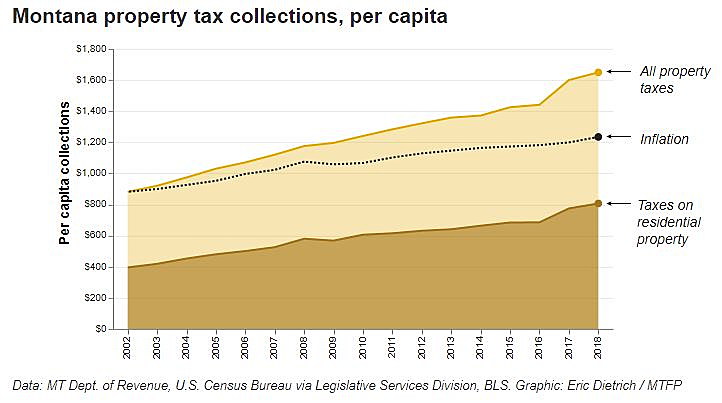

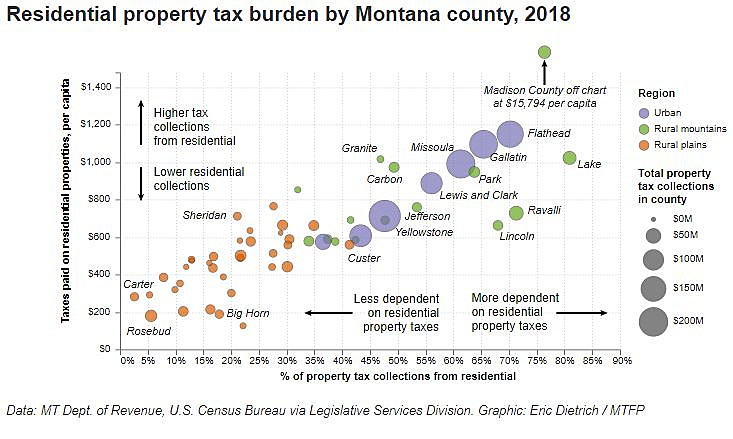

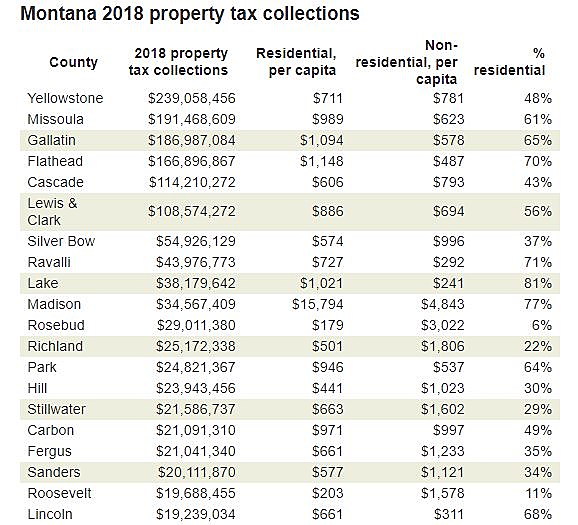

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

The Initiative That Could Upend Montana S Tax System Missoula Current

Montana Income Tax Mt State Tax Calculator Community Tax

Best State In America Montana Whose Tax System Is The Fairest Of Them All The Washington Post

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)